GENERAL CRITERIA

AND TARGETED ASSETS

Commercial assets

Residential assets

Green field and under development assets

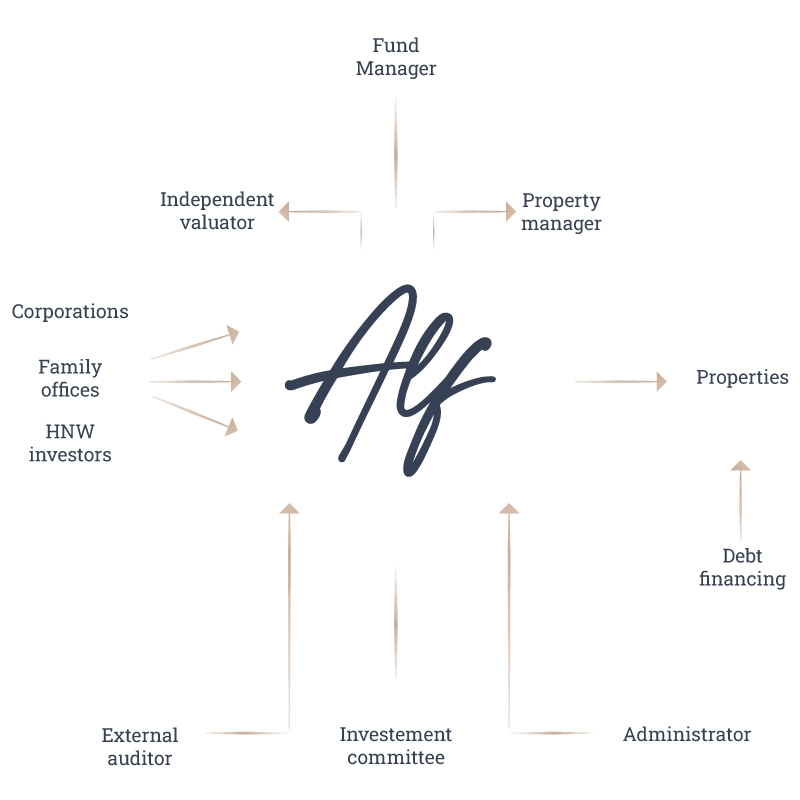

Al Rajhi Legacy Fund LP is a closed ended property fund incorporated in DIFC.

The purpose of the Fund is to acquire and accumulate a diverse portfolio of real estate assets to generate regular income from lease rental as well as capital appreciation.

The fund size is US$ 100 million and it’s equivalent in GBP.

The tenure of the fund is 10 years.

Capitalize on long term upside and yield compression

Sectors to include commercial retail, buy-to-let residential,data centers etc

Management services for the duration of the asset hold

Buy and hold high yield assets

Utilize bank leverage to enhance cash on cash yield asset and property

Exit as single assets for as a whole portfolio

Commercial assets

Residential assets

Green field and under development assets

A limited partnership fund structure established in the DIFC and registered with the DFSA as a property fund.

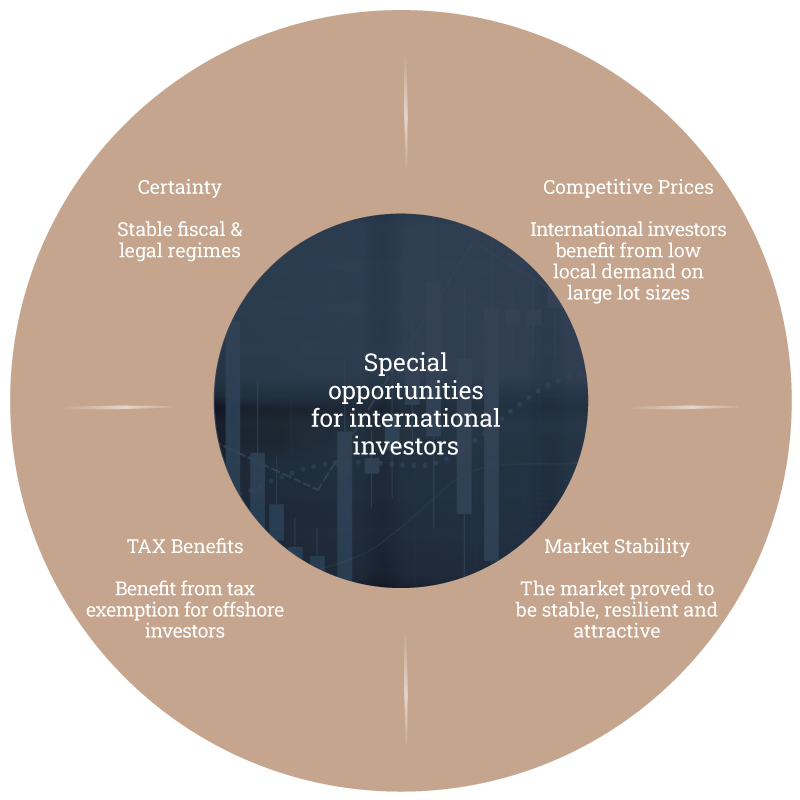

The Fund invest in a diversified portfolio of income generating real estate assets.

The Fund is focusing on the UK market though fund is also open to explore real estate opportunities globally.

The Fund intends to invest in both developed and greenfield properties.

Managed By: Ento Capital, Ento Capital Management Limited is regulated by the DFSA.

2023 © Ento Capital. All rights reserved. | Disclaimer